By Bruce Alder

While anyone can be a victim of fraud, we are seeing more and more scammers targeting retirees. Scammers target seniors because they are able to manipulate seniors to quickly gain their trust and confuse them into believing that they are either helping out a friend or investing in a profitable enterprise.

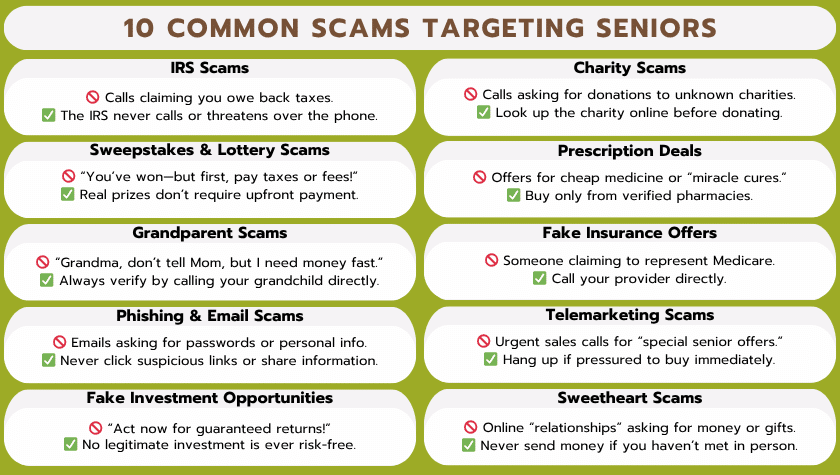

The fallout from a scam can be devastating. Millions of seniors have been persuaded to turn over retirement accounts, lifetime savings, pension checks and other financial benefits, resulting in losses averaging over $36 billion dollars a year nationwide. According to USBoomers.com, older adults comprise 12% of the US population, but represent 35% of all fraud victims. Some of the most frequently seen scams targeting seniors include IRS scams, sweepstakes and lottery scams, and grandparent scams.

The Most Common Scams That Target Seniors

IRS Scams

This scam involves you getting a phone call or voice message saying: “It’s the IRS and you have an outstanding tax liability that needs to be paid before you get arrested.” What do you do? Hang up or do NOT return that message or call! It is a scam. The IRS will NOT be calling you, and it will not be threatening you to immediately pay a tax liability.

Sweepstakes and Lottery Scams

These types of scams involve you receiving a letter, phone call, or email telling you that you won! It’s a lottery, sweepstakes, or some other prize. There may even be a real looking check enclosed with the letter for several thousands of dollars. But wait, there is a catch. They tell you there’s a fee, or taxes, or customs duties you have to pay. They ask for your bank account information to verify who you are or ask you to send a check or send money via a wire transfer or to purchase gift cards and provide the card numbers in order to collect your remaining winnings. It is a scam. True lotteries or sweepstakes don’t ask for advance money. If they want money for taxes, they are mostly likely crooks. As my grandmother always told me, “There is no such thing as a free lunch.”

Grandchild Scams

These types of scams involve you getting an urgent call from someone claiming to be (and you think is) your grandchild. The “grandchild” claims to be traveling and has gotten into a bad situation (like being arrested for drunk driving or in a car accident) and needs money wired to them ASAP. They also say, “Don’t tell mom or dad.” You think to yourself, the distraught caller does sort of sound like your grandchild, but you are only reacting to the situation; you are caught off guard. What do you do? Resist temptation to react or act quickly. If you feel you need to ask this person questions, ask questions to which only true family members know the answers. Don’t send any money. Hang up and call your grandchild’s home number or cell number—the numbers you know, not the numbers given by the caller. And call their parents too. You will discover the grandchild is usually safe and sound.

Email and Phishing Scams

Perhaps the most common scams out there are email scams and phishing schemes. Phishing refers to an scam in which the scammers sends an email under the guise of a reputable company requesting personal information from an individual. Scammers use the information collected by phishing emails to extort money, distribute malware or computer viruses, or elicit private usernames and passwords from individuals.

Phishing emails are tempting because they often look like legitimate emails from true companies. It is important to remember, however, that no bank, business, or website will request that you provide such personal information in order to fix a particular issue. Don’t click any links or offer any personal information if you receive an email requesting such information.

False Investment Opportunities

An unsolicited call or email from a financial advisor offering a once in a lifetime investment opportunity is another common trick used by scammers. These scammers often make their offer with a sense of urgency, trying to convince you to make a rash decision before time runs out. Another repetitive tactic used by investment scammers is to entice seniors by promising big financial returns that will ensure financial stability throughout the duration of the individual’s retirement.

Fake Charities

Scammers also extort funds from seniors by pretending to be a charity or philanthropic institution. In these situations, scammers take advantage of a senior’s compassion by sending out an email or reaching out by phone, requesting donations to support the charity. Instead of the donation going to a good cause, the scammer collects and pockets the money. A good way to confirm whether or not a charity is a true organization is to do a quick internet search of the organization’s name. If no results appear, the request for a donation is likely a scam.

Deals on Prescriptions

Many seniors are required to take various prescriptions to treat illnesses or maintain their health. Some seniors have difficulty paying for medications and are in search of cheaper alternatives. Scammers know this and will frequently reach out to seniors with special deals on prescriptions and medications. In many cases, scammers will send counterfeit drugs to perpetuate the scam, but unfortunately, many of these false medications can be quite detrimental to the victim’s health.

Fake Insurance

Similar to the prescription scams, insurance scams exploit the fact that many seniors are in search of decent health insurance to cover high medical costs. However, insurance scams can go beyond health insurance schemes. Scammers have tempted seniors with dozens of insurance deals on home, auto, and life insurance in order to obtain personal information from seniors. In some cases, scammers will even impersonate Medicare representatives to elicit the desired information. True insurance companies will never ask for your personal information over the phone, so never provide that information to a representative who has called out of the blue.

Telemarketing Phone Calls

We all receive calls from telemarketers from time to time, and while many can be harmless, others are scammers in disguise. Many false telemarketers target seniors offering products that appeal to seniors such as products that will reduce the signs of aging, various health supplements, or other products that increase the independence of a senior citizen (such as emergency alert devices). These false telemarketers often use urgency as a tactic to pressure the victim to not wait and purchase the item now. Additionally, these calls can often automated and the message will not begin until you say hello. If you answer the phone, but do not speak, and only hear silence, it is most likely a telemarketer and you can hang up.

Sweetheart Scams

Although less common, sweetheart scams are another form of deception that typically targets seniors who have been recently widowed. In these scenarios, the scammer usually reaches out over social media, pretending to be a potential love interest. After gaining the trust or affection of the victim, the scammer will then begin requesting gifts or money from that individual.

How to Protect Yourself Against Scams Targeting Seniors

By taking to time to familiarize yourself with some common scams, you have already taken a huge step in ensuring your protection from unconscionable scammers. However, there is still more that your can do to help yourself.

It can be helpful to continue to regularly familiarize yourself with online safety resources. Before making investments or online payments, be sure that you have confirmed that the organization is a legitimate business by asking for information about the company and checking that they are registered with the Better Business Bureau. There are also a number of apps you can install in your phone that help identify fraudulent telemarketers.

If you do receive a phone call or an email from a person you don’t know, you should be suspicious. Never give out your personal information to a stranger requesting it by phone or email, and if you do encounter someone requesting that information, hang up the phone or delete the email. Avoid making quick decisions about an offer or sales promotion; instead always take a little extra time to think it through and evaluate its legitimacy. A good rule of thumb to follow when it comes to interacting with unknown offers or investments is that if it’s too good to be true, it probably is.

What to Do if You Think You Were a Victim of a Scam

If you’re worried that you might have been a victim of a scam, don’t be afraid to ask for help. Contact a trusted friend or family member and describe what happened. They will be able to help you take the right steps to get yourself protected and stop additional fraud from occurring. It is also important that you immediately get in touch with your local law enforcement and your bank. They will also be able to assist you if you’ve been scammed.

Unfortunately, there are people out there who try to take advantage of seniors. Knowing the warning signs and red flags can make all the difference.

Scammers tend to target seniors with all types of scams, often taking advantage of their isolation, ease of trust, higher savings, and lack of tech savvy, among other things. Realizing that enforcement authorities state that the best defense against scams is increased awareness of them, Living Branches provides regular Safety Minute presentations on the latest scams to residents at periodic resident meetings.